Tax Update: The proposals in the American Families Plan

The news is full of information regarding the newly released proposals from the Ways and Means Committee called the American Families Plan. While the plan doesn’t include the high degree of change requested by President Biden, there are still substantial changes we wanted to highlight.

It is important to remember that these are still only proposals and may change before passage.

Income taxes changes

-

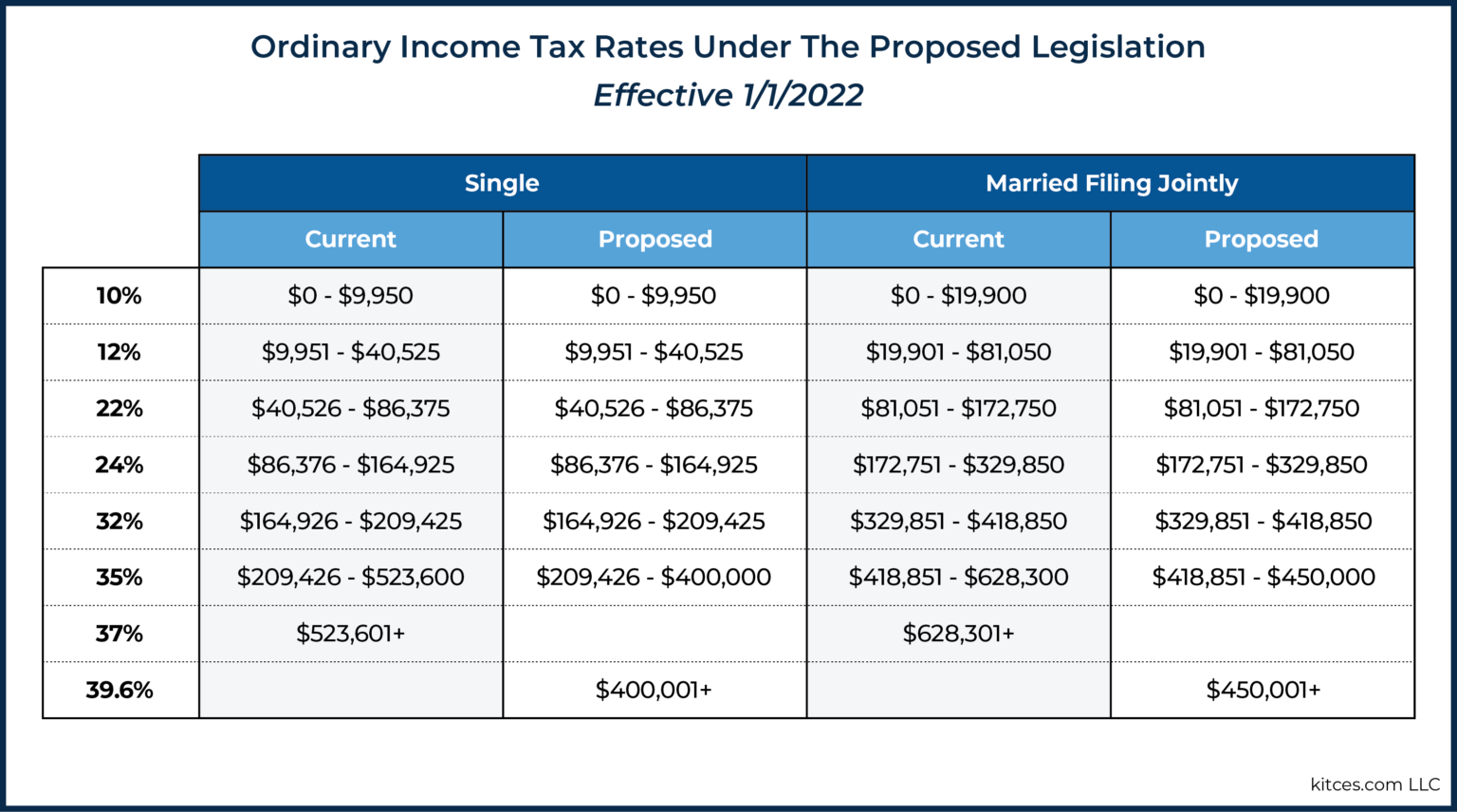

The bill proposes increasing the top federal marginal rate from 37% to 39.6% for income over $400K for single filers and $450k for joint filers

-

Additionally, it would compress the current 35% bracket and would create a new top bracket of 39.6% above that.

-

Adds a 3% surtax on all MAGI over $5M. The threshold for trusts is only $100k.

Capital gains tax changes

-

The bill proposes increasing the top capital gains rate from 20% to 25%. This would start at an income level of $400k for single filers and $450k for joint filers.

-

The effective date for these capital gains rates is 9/13/21. There is an exception for people with written contracts for sale that existed prior to 9/13/21.

S Corporation Tax Changes

-

Business profits from S Corporations will be subject to a 3.8% surtax for taxpayers with MAGI over $400k for single filers and $500k for joint filers.

-

Factoring in the increased income tax rates and S-corp rates would mean the top S-Corp rate increases from 37% to 43.4%

Qualified Business Income Deduction

-

Section 199A deduction (Qualified Business Income Deduction or QBI) limited to $400k single filers and $500k joint filers.

ROTH Conversions Prohibited or Reduced

-

ROTH conversions of after-tax funds in retirement accounts would be prohibited for all taxpayers starting 1/1/2022.

-

This is bad news for one of our favorite strategies, the backdoor ROTH

-

This also means after tax contributions in 401ks will stop

-

-

The bill prohibits all ROTH conversions for taxpayers in the highest (39.6%) ordinary income tax bracket, starting 1/1/2032 (i.e., 10 years to convert for our highest earning clients)

Retirement Plans

-

The bill prohibits IRA contributions if taxable income is greater than $400k for single filers and $450k for joint filers AND the total value of IRA and defined contribution plans is > $10M.

-

It imposes required minimum distributions (RMDs) on large retirement account balances if they exceed $10M and the taxpayer is considered a high earner (same $400k/$450k income limits).

New Wash Sale Rules

-

The plan includes explains that additional asset types would be subject to the IRS wash sale rule in 2022, including:

-

Cryptocurrency/digital assets

-

Foreign currencies

-

Commodities

-

Business losses

-

The bill makes permanent the current limit on excess business losses, which are considered losses over $250k for single and $500k for joint filers. These losses are disallowed and carried over to the following year.

Child Tax Credit & Child/Dependent Care Credit

-

The bill extends the increased child tax credit and monthly advanced payments ($250 per qualifying child age 6-17/$300 per child age 0-5 through 2025).

-

The credit is fully refundable. This means that even if the taxpayer has no tax liability at all, they still receive the credit.

-

It makes permanent the American Rescue Plan Act’s increased Child & Dependent Care Credit.

-

Qualifying expenses: up to $8,000 for one qualifying individual or $16,000 for multiple, with two phaseouts.

-

Credit for Caregiver Expenses

-

The bill introduces a new non-refundable credit for expenses paid or incurred by a qualified care recipient.

-

Maximum $4,000 credit – phaseout begins at $75,000 of income.

-

Estate Planning

-

Moves the individual estate tax exemption back to the 2017 level of $6M ($10M per couple)

-

The Family Limited Partnership discount is being curtailed for “nonbusiness” (i.e., passive assets, investments) interests that are transferred to family members.

There is a lot that could change and some strategies we can proactively take this year to minimize taxes. For example, we may accelerate income into 2021 and defer expenses in 2022 to pay at the lower rates of this year. Deductions like charitable giving and property taxes can be stacked into 2022 to reduce taxable income. Last, we will want to use ROTH conversion strategies this year that may not be available in the years to come. We have frequent contacts with our contacts in Washington D.C. and will keep you updated on the latest.

.webp?width=2500&height=1667&name=unsplash-image-6xafY_AE1LM%20(1).webp)