Dental Practices

-

Planning for practice growth, sales, or partnership transitions

-

Coordinating tax and savings strategy with practice cash flow

-

Hiring associates and staff while managing overhead

Planning for practice growth, sales, or partnership transitions

Coordinating tax and savings strategy with practice cash flow

Hiring associates and staff while managing overhead

Managing uneven income and variable cash flow

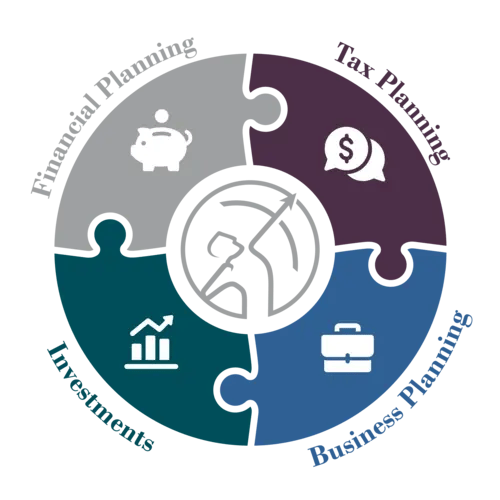

Coordinate tax and savings strategy with long term financial goals

Planning for growth, ownership changes, and long-term transitions

Business owners with high income and complex tax and cash flow decisions

Those seeking coordinated financial planning, tax, and investments from one firm

Clients who value a fee-only fiduciary advisory relationship with an ongoing relationship model

We build the plan, run the projections, manage the portfolio, and help you make the decisions without handoffs.

Proactive tax savings strategies throughout the year, not just filing at year-end.

Tax-aware investment portfolios designed for long-term growth.

Practical action items and advice to address real problems owners confront.

Choose how you'd like to connect with us.

Fee-only fiduciary. No commissions. No spam. Unsubscribe anytime.