2023 has been a complicated year for investors. We highlight five themes we see from the data and key principles long-term investors should keep in mind.

The 'Magnificent Seven' are the best show in town in 2023.

After an abysmal 2022 performance, the media titled 'magnificent seven' companies have rallied in 2023. The magnificent seven include Facebook, Microsoft, Apple, Google, Amazon, Tesla, and NVidia.

These companies are not only highly successful and profitable, but they have also capitalized on the excitement surrounding AI, fueled by Chat GPT.

It's not a stretch to say that Chat GPT saved the S&P 500 this year.

The remaining 493 companies in the S&P 500 are only up 0.95% through 10/13.

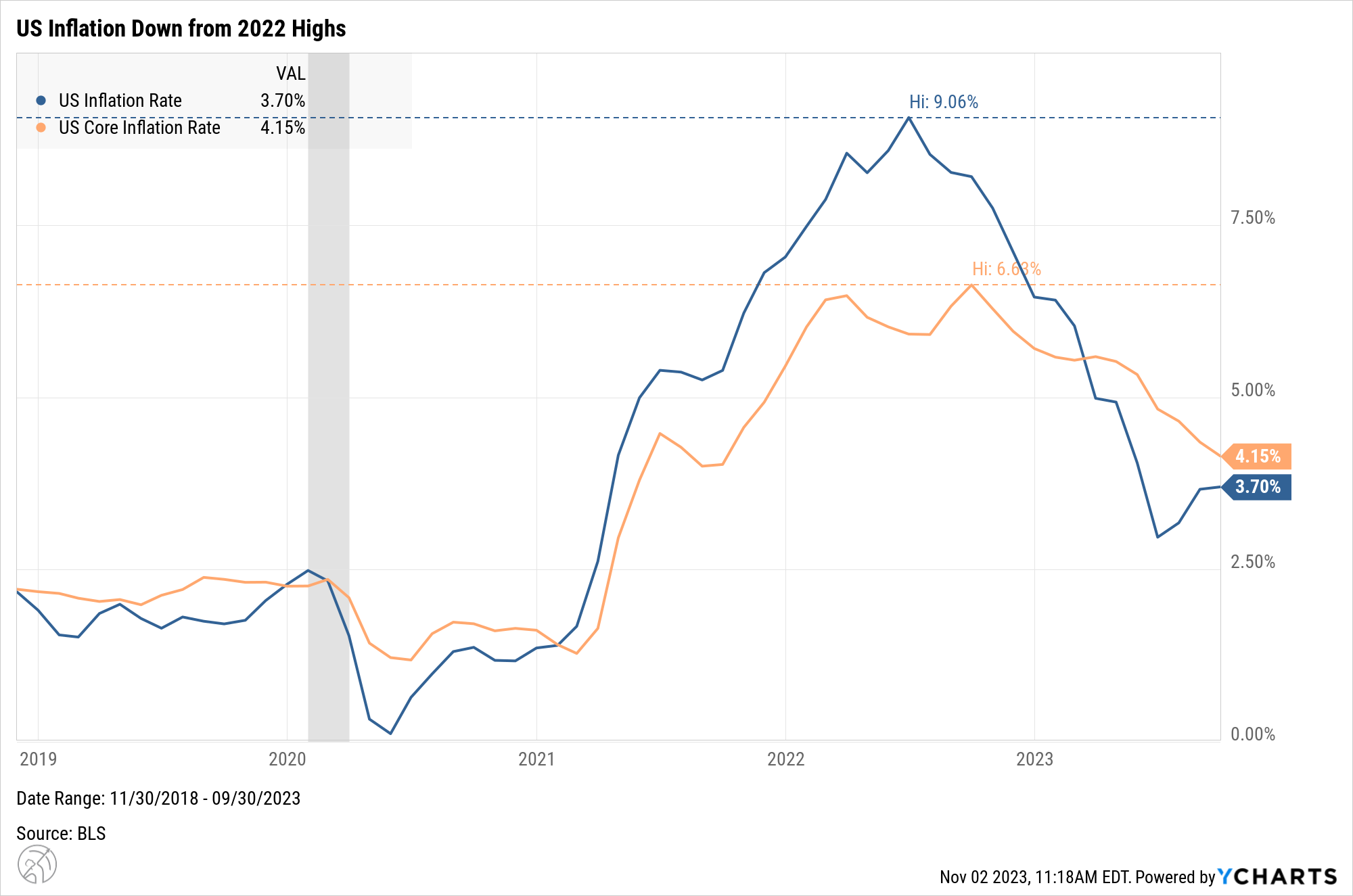

The inflation roller coaster is hopefully almost over.

Inflation, which reached its peak in 2022, has gradually moderated and stabilized in the following year. The efforts made by central banks and governments to tackle rising prices have started to show positive results, bringing relief to consumers.

Furthermore, the challenges posed by supply chain bottlenecks and shortages are gradually diminishing.

A perfect example of inflation flattening out is in residential real estate. Recent increasing trends in 30-year mortgage rates have caused a stabilization in home prices, illustrating the impact of interest rates on prices in the housing market.

.png?width=2000&height=1325&name=IUS30YMR_IUSEHMSP_chart%20(1).png)

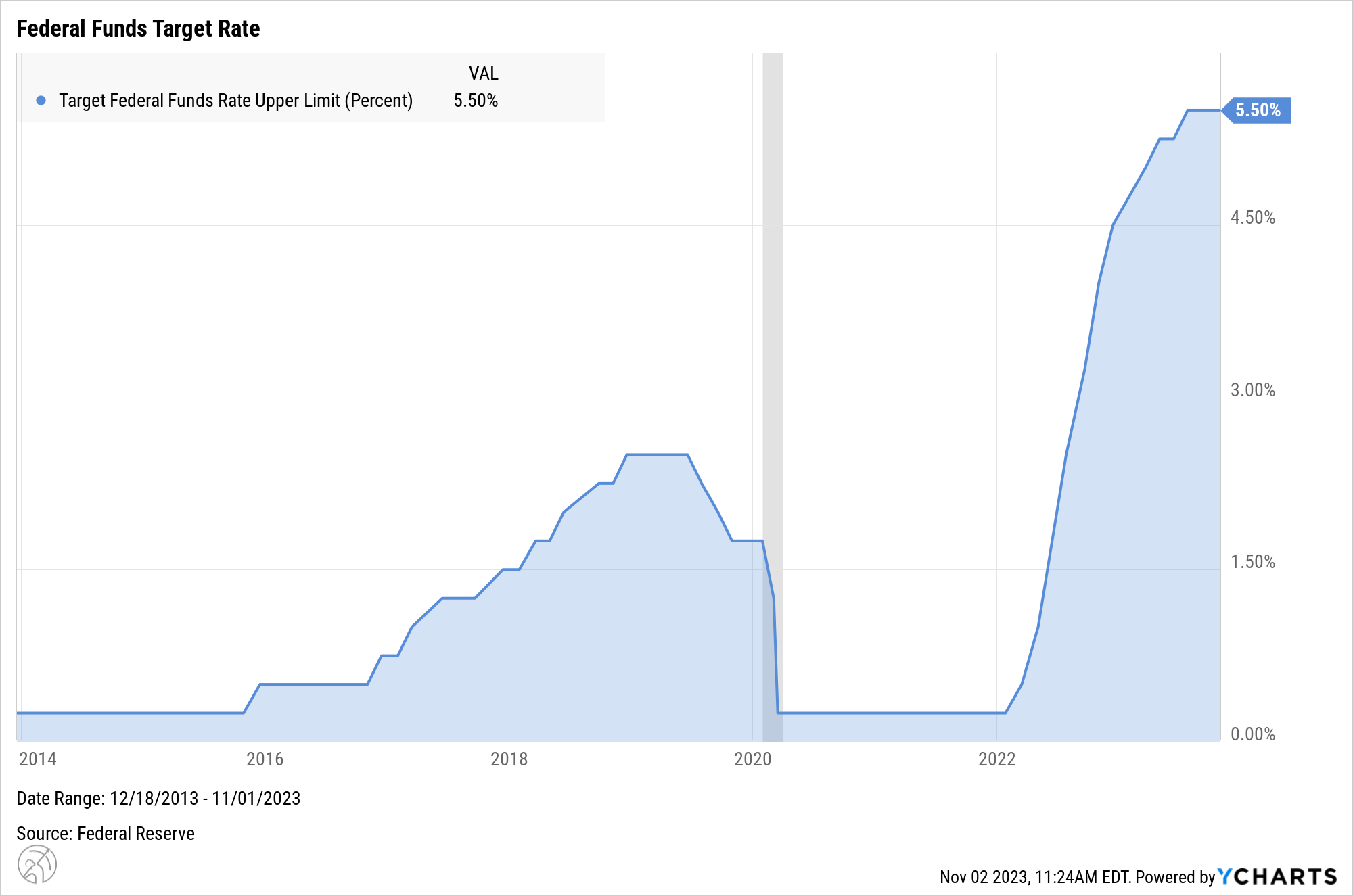

The Federal Reserve May Finally Be Done with Interest Rate Increases

The Federal Reserve uses higher interest rates to combat inflation similar to how doctors use medicine to cure a disease. Interest rate 'medicine' can cool hot markets, but in high doses, could put the economy into recession if rates start to diminish consumer demand.

Based on the most recent inflation data, it is becoming increasingly evident that the Federal Reserve is nearing a point where they may put a temporary halt to interest rate increases and potentially even lower rates next year. This pause in rate increases could have a positive impact on the stock market moving forward.

For a live look at the probability of Fed Rate increases, there is a website called FedWatch. Here is the link.

Bonds and Money Market Funds are Finally Paying Interest

.png?width=2000&height=1325&name=I30YTCMR_I10YTCMR_I5YTCMR_I3YTCMR_I2YTCMR_I1YTCMR_I3MTCMR_chart%20(1).png)

We are finally getting paid to own treasuries!

These higher bond rates mean we can own bonds, receive a healthy income, and hopefully see some price appreciation over time. While it has been painful to own bonds over the past two years, we anticipate better bond returns in the future.

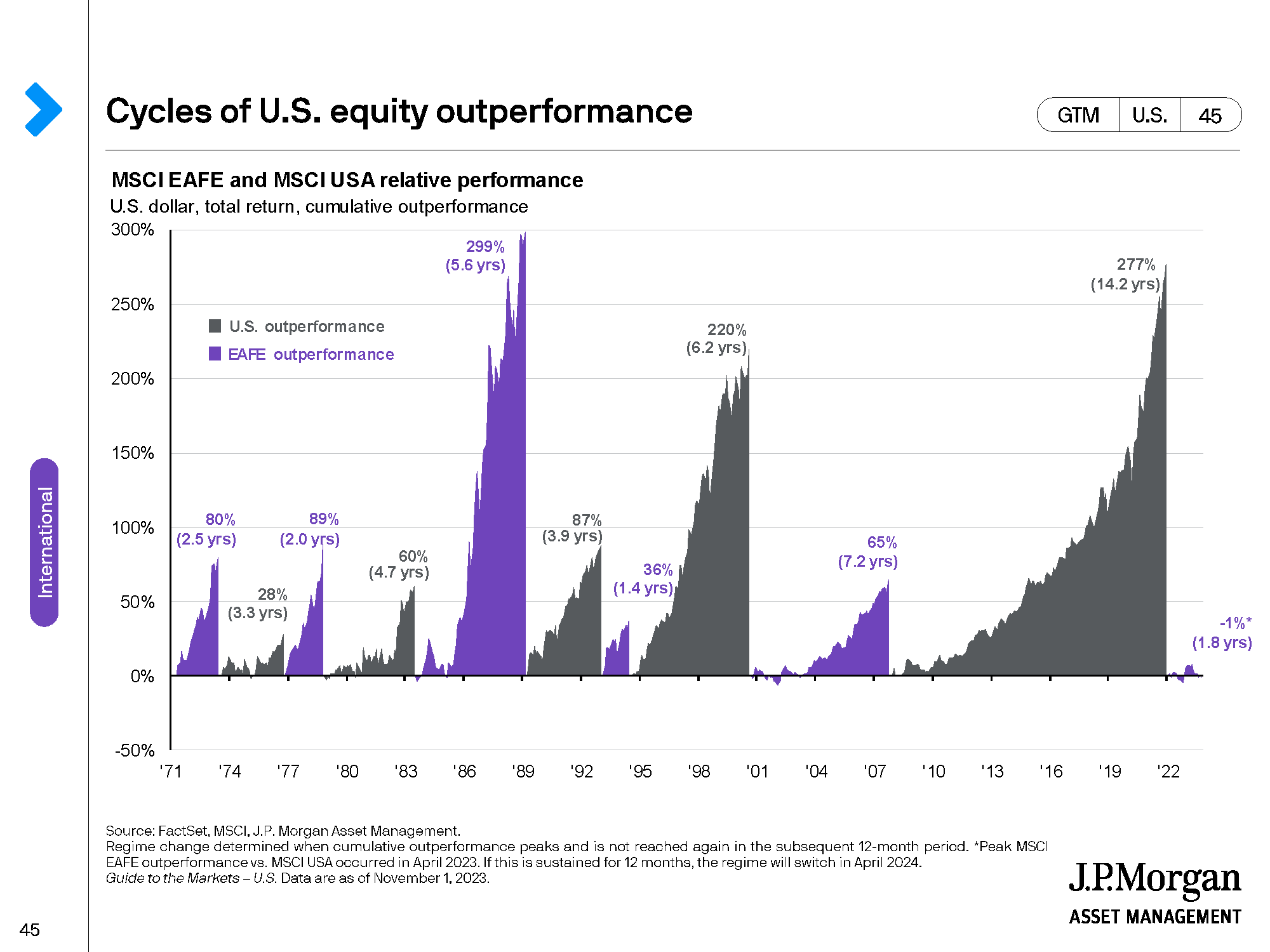

International Investments Still Trailing the US but History Reminds us to Stay Diversified

Maintaining a diversified portfolio is crucial for long-term investors. Over most of the past decade, the United States has dominated global equity stock performance, and this year is no exception.

Despite initial gains for international stocks in 2023, the US has powered ahead with strong gains in the Magnificent 7 as referenced above.

However, it is important to recognize that market momentum can swing like a pendulum, demonstrating the importance of maintaining an international allocation.

Chinese equities have declined due to a challenging real estate market, less than rapid consumer spending, and negative international investor sentiment. If we start to see the rebound of Chinese consumer spending, Chinese equities could rebound quickly.

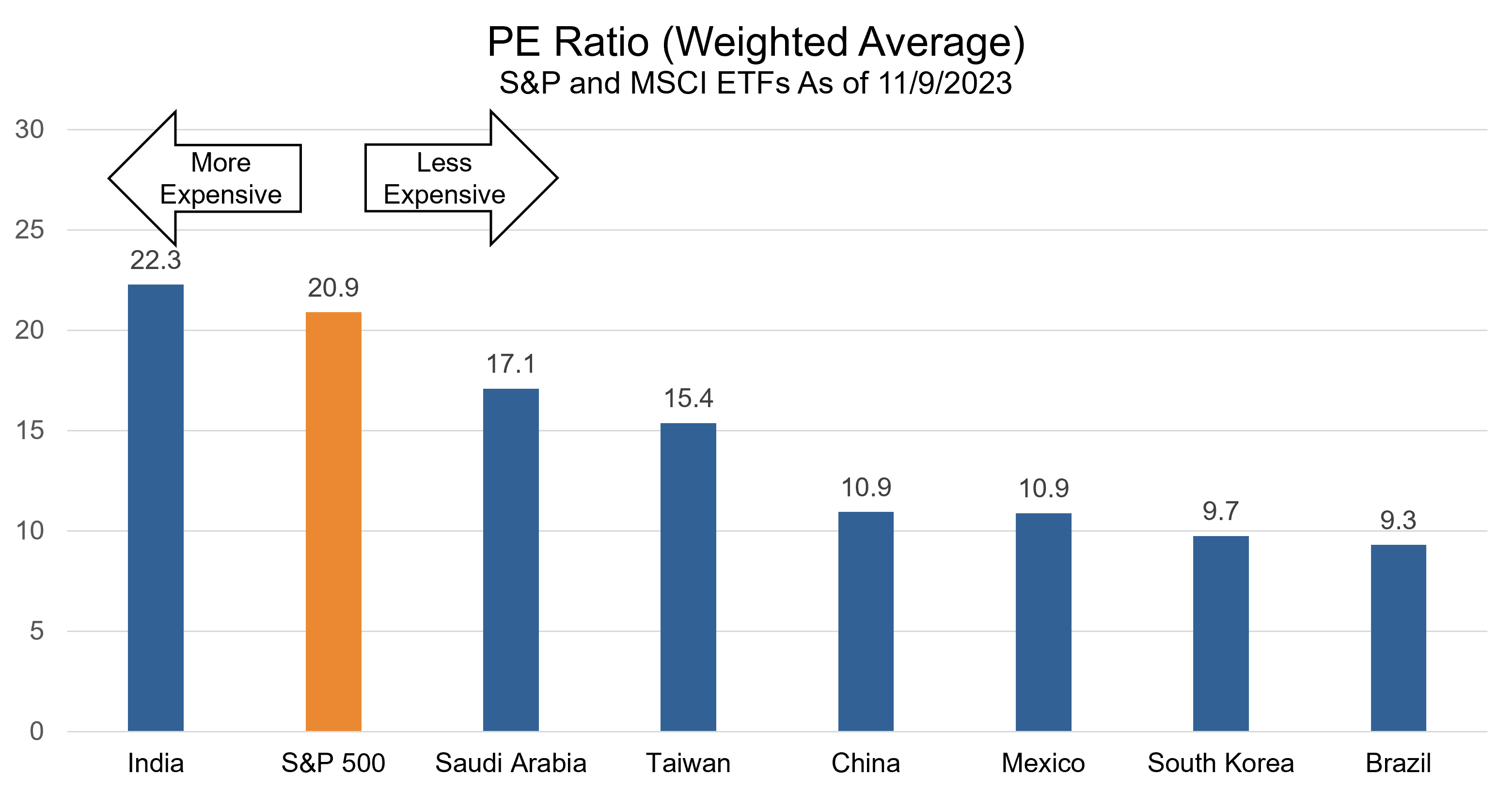

Moreover, international companies are currently offering great bargains compared to their US counterparts, as indicated by the price-to-earnings ratios displayed in the above chart.

Except for India, these companies present an opportunity to acquire nearly 25 - 50% more earnings when investing in an average company from countries like Brazil, China, Mexico, South Korea, and Brazil, compared to investing in an average US company.

Important Principals for Long Term Investors

As we navigate through the ever-changing market landscape, it is crucial for long-term investors to keep a few fundamental principles in mind.

-

Manage risk through diversified asset allocation.

-

Do not try to time the market.

-

Tax-efficient strategies are important to long-term returns.

-

Keep investment expenses as low as possible.

Subscribe to our blog!