The SECURE Act 2.0 was passed in December of 2022 and contains roughly 100 changes to retirement provisions affecting RMDs, retirement plans, and education savings accounts. The changes in 2.0 are relatively minor compared to 1.0, but the quantity of changes (100+ in SECURE 2.0 vs. 12 in SECURE 1.0) means there is a lot to review.

Here are the 9 biggest headlines from SECURE Act 2.0.

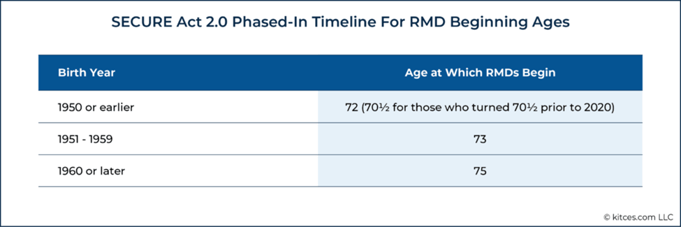

- The Required Minimum Distribution (RMD) age increased, and the penalty declined for missed withdrawals.

- Detail: For people born between 1951 and 1959, the RMD age moves from 72 to 73. People born after 1960 now have to take RMDs at 75. Also, if you miss an RMD, the penalty drops from 50% to 25% and can even go to 10% if corrected quickly.

- Strategy: The change provides more time for tax planning strategies such as Roth conversions, qualified charitable distributions (QCDs), etc.

- No major restrictions on Roth accounts that we feared. Congress likes the revenue the Roth generates and seems willing to expand access.

- Detail: Prior to the legislation publication, we had concerns that Congress would restrict or eliminate our favorite Roth strategies (backdoor Roth, Roth Conversion, etc.) and these provisions were NOT in the bill.

- Strategy: Continue using Roth accounts in our tax planning.

- 529 Plans can be Transferred to Roth IRAs for beneficiaries.

- Detail: Starting in 2024, below are requirements to transfer 529s to Roth IRAs:

- 529 Beneficiary is SAME as Roth IRA Beneficiary

- 529 must be 15 years old

- 529 Contributions in previous 5 years may not be moved

- Eligible dollars are reduced by other IRA or Roth Contributions

- $35,000 max transfer

- Strategy: The concern with 529’s is always, “what if my child doesn’t go to college”. Now we can fund retirement with 529 funds that are not used for college.

- Detail: Starting in 2024, below are requirements to transfer 529s to Roth IRAs:

- Elimination of RMD for Roth 401k accounts starting in 2024.

- Detail: Roth 401ks required RMDs but Roth IRAs did not. The removal of Roth 401k RMDs will align the rules and remove this quirk for retirement plans.

- Strategy: Keep more Roth funds in retirement plans than rolling to a Roth IRA.

- Congress added a ROTH option to SEP and SIMPLE plans starting in 2023.

- Detail: This change adds a post-tax option to SEP and SIMPLE plans for small business owners. Previously, SEP and SIMPLE plans were only for tax-deferred contributions.

- Strategy: SEP and SIMPLE plans are inexpensive plan types for owners starting out and the ROTH environment is normally our preference. We must wait for custodians (i.e., Charles Schwab) to offer these account types so that we can use them.

- Employees (50+ years old) paid more than $145k annually can only make Roth catch up contributions.

- Detail: Previously, we could select pre-tax or post-tax for the catch up contributions into a retirement plan. Now, Congress wants high earners (+$145k) to use Roth.

- Strategy: Ensure retirement plans offers a Roth option to take advantage of the catch-up. i.e., no Roth option in the plan = no catch-up contributions for participants.

- Sole Proprietors can setup a 401k retroactively in the first year.

- Detail: Starting in 2024, sole proprietors and single member companies can now setup a retirement plan after the year is over and take a prior year deduction. For example, an employer could setup a 401k plan in February 2023 and contribute money for a 2022 tax deduction.

- Strategy: We can now use solo 401k plans to reduce prior year income after the year is finished and before the tax return is filed. This change provides us more flexibility in our tax planning.

- Effective in 2024, employers can match employee STUDENT LOAN payments into their retirement plans.

- Detail: Employers can match student loan payments by contributing to their company retirement plan. Contributed amounts will vest immediately.

- Strategy: This provision will be attractive for employees with substantial student loan debt.

- Effective in 2023, new retirement plan costs qualify for a 100% start-up and contribution credit.

- Detail: The retirement plan startup credit is up from 50% to 100% for employers with 50 or fewer employees up to certain limits. In addition, the plan receives a credit for employer contributions for the first four years.

- Strategy: This credit makes retirement plans more affordable for new businesses that want to use a retirement plan.

The other provisions included in the SECURE Act 2.0.

- Catch Up Contribution Limits increased in 2025 for 60 – 63-year-old plan participants

- Qualified Charitable Distributions limits are now indexed for inflation

- New rules for accessing retirement funds during times of need

- Creation of emergency savings accounts that are linked to company retirement plan

- ABLE accounts now available to older disabled individuals

- Rule changes for Annuities (QLACs, IRA annuities, Variable Annuities, and Variable Universal Life Policies)

For more detailed analysis on the remaining provisions in the Act, visit the link below:

Secure Act 2.0: Detailed Breakdown of Key Tax Opportunities (kitces.com)