Owner-operated B2B Service Firms

Integrated Business and Personal Advice for Owners

Align growth, acquisitions, exits, and uneven income with a tax‑smart, long-term wealth plan.

Challenges Owner‑Operated B2B Service Firms Encounter

Front line employee management

Utilization and capacity planning

Profit sharing and bonus program planning

Tax planning for uneven income

Long-term transition planning

Acquisitions or sales

Scaling for growth

Service Pricing Models

How We Help

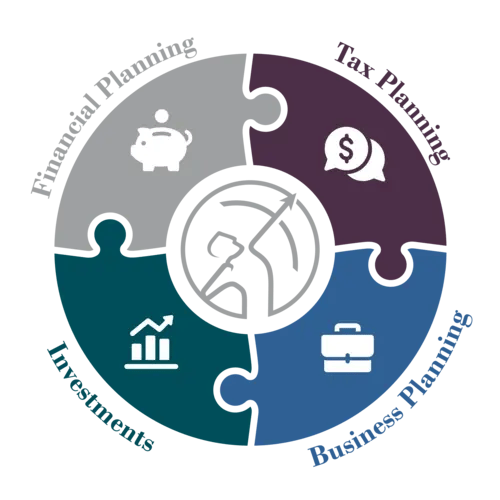

Integrated Planning, Tax, Investments, and Business Consulting

- Financial planning for your business and family

- Proactive tax planning for uneven income

- Investment management that is linked to your goals

- Business consulting on pay and succession

J.E. Simmons and Company Capabilities

Compensation Planning

Transition planning

Proactive tax planning

Scaling for growth

Treasury Operations

What you can expect

Coordinated Advice, Delivered on a Schedule

- Annual full-picture reviews

- Quarterly check-ins

- Direct access to CPAs and CFP®

- Plan ten years ahead, not year-to-year

- Proactive tax projections and planning

- Ownership compensation advice

Firm Owner Case Study

The Situation

A B2B transportation firm owner approaching retirement with strong financials but limited clarity around succession planning and retirement timing.

Key Questions Included:

- Are we on track to retire soon if I find a buyer?

- How do we transition out of owning the business?

- Where do we put our excess cash for now?

- How do we reduce tax if we sell?

- How do I take care of my employees?

Approach

We assessed their business and personal financials, cash flows, taxes, and investments.

Our work focused on:

- Built long term retirement and cash flow forecast

- Structured owner compensation and tax withholding

- Hired family members to assist in the business

- Utilized a profit-sharing plan and 401k

- Set up a donor advised fund

- Shifted savings to post-tax (Roth) accounts

- Implemented a direct indexing investment account

Client Outcome

The client had a documented plan for cash, taxes, transition, and retirement.

- Lowered current and future tax exposure

- Improved business and personal cash position

- Increased retirement savings in tax-advantaged accounts

- Provided clear, actionable to-do list

- Shifted cash to higher yielding investments

All of this was coordinated across tax, investments, and business planning by one team.

Frequently asked questions

Do you work with different types of owner-operated B2B services firms?

Yes. We work with owner‑operated B2B service firms such as

- Supply chain services

- Marketing agencies

- Trade and specialty contractors

- Technology service

- Transportation and logistics

Can you help even if I am not planning to exit soon?

Absolutely. Succession planning often starts years in advance. Early planning creates more flexibility around growth, transitions, and eventual exit options.

How do you help with uneven income and cash flow?

We help owners understand how utilization, billing cycles, and compensation decisions affect cash flow so planning is based on realistic assumptions rather than averages.

Do you coordinate personal planning with firm finances?

Yes. Owner income, taxes, investments, and long-term goals are all connected. We coordinate planning so firm decisions support personal outcomes.

Do I need to live in Dallas to work with you?

No. We work with professional services firm owners nationwide. Clients often travel to Dallas once per year, or as needed, to review their full plan, with ongoing monitoring and check-ins handled virtually.

How do I get started?

We begin with an introductory call to understand your firm, your goals, and the decisions you are facing, and to determine whether our approach is a good fit.

Ready to get started?

Choose how you'd like to connect with us.

Subscribe to Insights

Tax and planning notes for business owners, 1 to 2 times per month.

Fee-only fiduciary. No commissions. No spam. Unsubscribe anytime.