Q1-Q3

Tax projection updates

Estimated tax planning

Salary and withholding planning

Retirement plan analysis

Tax Planning and Preparation

Proactive tax planning and accurate filing.

We evaluate income, deductions, and timing decisions throughout the year to reduce unnecessary taxes before returns are filed.

Guidance on entity structure, owner compensation, and income planning tailored to practice owners and closely held businesses.

Regular estimates and scenario analysis so you understand your tax exposure before year end, not after.

Tax decisions are coordinated with retirement planning, investments, and major life or business changes.

Aligning tax planning with portfolio decisions, retirement contributions, and capital gains management.

Accurate preparation and filing of individual and business returns, built on the strategy developed throughout the year.

Tax projection updates

Estimated tax planning

Salary and withholding planning

Retirement plan analysis

Business Profit Projection

Personal Income forecast

Year-end strategy meeting

1040 Filing

1120S Filing

1065 Filing

State returns

Tax touches most decisions.

Coordinate tax, planning, and investments so they work together, not against each other.

Owners with S corporations, partnerships, real estate, or trusts need coordinated planning across all moving pieces.

We plan ahead to lower avoidable taxes, manage withholding and estimates, and reduce surprises.

We model the transaction early to reduce tax through timing, structure, and purchase price allocation.

Designing and coordinating defined contribution, profit-sharing, and defined benefit or cash balance plans to align tax savings with business cash flow.

Strategic conversions coordinated with income levels, investment positioning, and future tax projections.

Modeling decisions in advance to understand tradeoffs ahead of time.

Coordinating charitable gifts, donor-advised funds, and appreciated assets to improve tax efficiency while supporting philanthropic goals.

Selecting and optimizing the right entity to balance taxes, cash flow, retirement contributions, and future transition options.

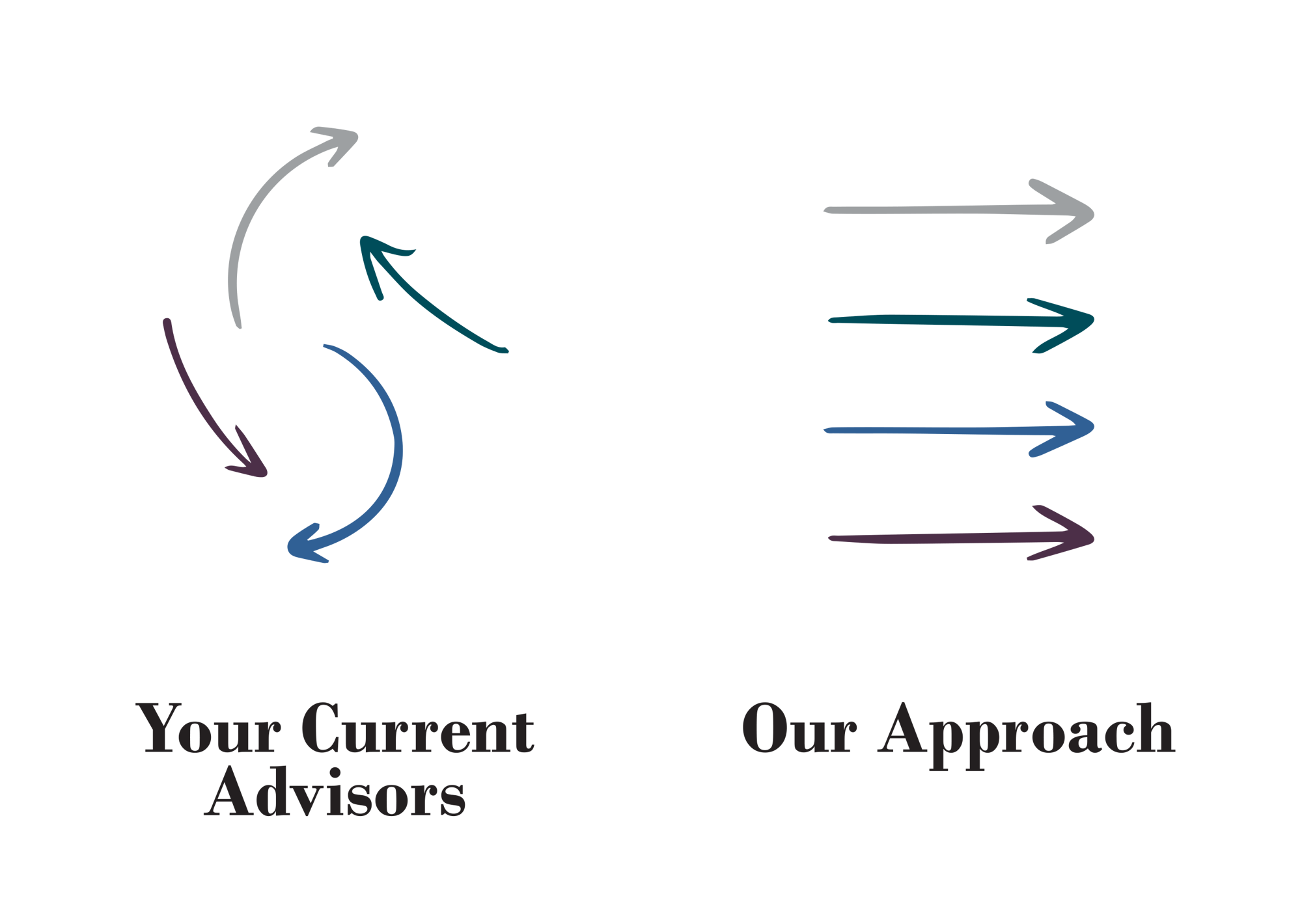

Tax preparation reports what already happened. Tax planning focuses on decisions made throughout the year that influence what you ultimately owe. Planning comes first, filing comes last.

No. Tax planning is ongoing. We work with clients throughout the year to review income, cash flow, and planning opportunities so there are no surprises at filing time.

We stay up to date on federal and Texas state law changes. We also extend that expertise for the states that our clients operate in.

Yes. We prepare individual returns as well as business, trust, partnership, and S corporation returns and coordinate them as part of one integrated strategy.

In many cases, yes. The biggest savings typically come from income timing, entity structure, retirement contributions, and coordinated planning rather than last minute deductions.

Tax planning is coordinated with retirement planning, investment decisions, and major life or business changes so strategies work together instead of in isolation.

We start with a conversation to understand your situation, goals, and complexity and determine whether our approach is a good fit.

No. We work with business owners nationwide. Clients often travel to Dallas once per year or as needed for an in-person review of their full plan, and we meet virtually for quarterly check ins, monitoring, and time sensitive decisions.

Check out our process and fees page for more information on fees.

Choose how you'd like to connect with us.

Tax and planning notes for business owners, 1 to 2 times per month.

Fee-only fiduciary. No commissions. No spam. Unsubscribe anytime.